As your business grows, QuickBooks can quickly become a bottleneck as your needs evolve. From scalability issues to limited reporting capabilities, relying on desktop accounting software can hinder growth, consume valuable resources, and expose your business to compliance and security risks. In this article, we’ll explore five signs that your organization has outgrown QuickBooks and why upgrading to an ERP system is the next crucial step for you.

1. Your Business Growth is Limited by Scalability Issues

As your business grows, you may find that desktop accounting systems have a hard time keeping up with your needs. Limitations like user caps can restrict collaboration among your team, and file size constraints can lead to performance slowdowns and even data corruption. Finally, although QuickBooks add-ons are sold for inventory and shipping management, they don’t integrate efficiently and often cause more harm than good.

Transitioning to an ERP system can address these challenges by supporting growth and easing QuickBooks’ pain points. These systems can support larger teams and higher transaction volumes without performance issues. They include built-in functionalities for inventory tracking with real-time stock monitoring, automated order processing, and multi-location management, giving you visibility and automation across your operations.

2. Your Reporting and Insights are Not Keeping Up

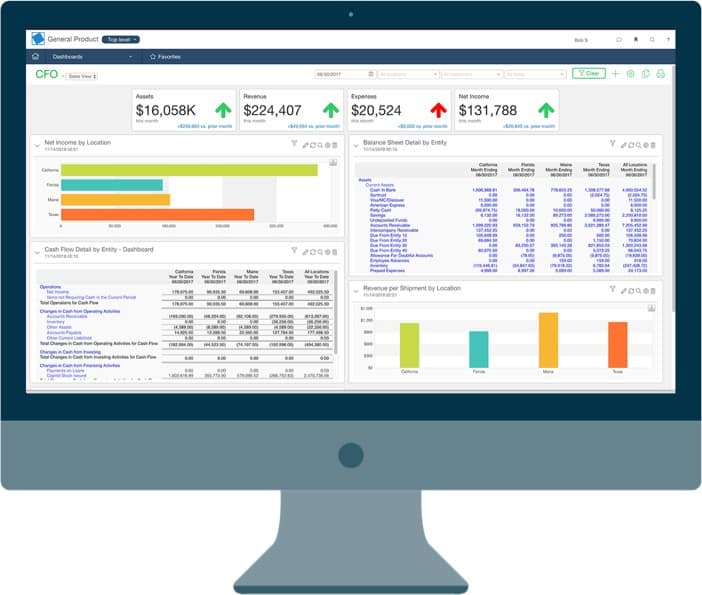

Small accounting systems don’t meet the reporting demands of a growing business. Their basic reporting tools lack the depth and flexibility needed to give you an understanding of key performance metrics. Consolidating financial reports can become a tedious, manual process, prone to errors and inefficiencies. Additionally, real-time visibility into cash flow and overall performance is missing, making it harder for you to make informed decisions in time.

ERP systems can solve these problems with their advanced reporting and analytic capabilities. These systems offer multidimensional reporting, customizable dashboards, and real-time data visibility. For instance, Sage Intacct delivers role-based dashboards that present financial, operational, and cash flow data in one interactive view. With the use of these tools, your organization can eliminate unnecessary manual workarounds and focus on strategic decision making backed by accurate, up to the minute insights.

3. Compliance and Security are Becoming a Growing Risk

Keeping compliance with evolving regulations and maintaining data security becomes increasingly difficult as your business progresses. QuickBooks lacks automated updates for frameworks such as GAAP, IFRS, or ASC, leaving your team to manually adjust to regulatory changes. Additionally, it does not offer advanced features like role-based access controls, encryption, or real-time threat detection, exposing sensitive financial data to potential breaches. Tracking tax codes, audit trails, and other regulatory updates manually not only consumes time but also increases the risk of errors. For industries subject to strict privacy laws like GDPR or HIPAA, QuickBooks’ limitations in data security can result in significant compliance risks.

Moving to an ERP system is an important step in addressing compliance and security challenges. These systems provide tools to support financial standards such as GAAP and IFRS, along with features like role-based access controls, encryption, and detailed audit trails. These functionalities can help your business manage GDPR, CCPA, HIPAA and other information privacy regulations, and help protect sensitive financial data. Maximizing the benefits of these systems requires proper configuration and consistent monitoring to align with your specific compliance needs. By leveraging an ERP’s proactive security measures and comprehensive compliance capabilities, your business can confidently navigate complex regulatory landscapes and safeguard critical data.

4. Integration Gaps are Slowing Down Your Operations

One of the most common issues with desktop accounting systems is their inability to integrate seamlessly with the modern tools your business relies on, such as eCommerce platforms, CRM systems, or HR software. This key limitation prevents real time data sharing and isolated systems, leaving you to manually transfer information — a process prone to errors and time delays. Additionally, these gaps leave businesses investing in multiple third part tools, which increases costs and creates even more inefficiencies.

An ERP eliminates these integration issues by offering robust compatibility with a wide range of business tools and industry-specific applications. For instance, Sage 100 integrates with leading eCommerce platforms, customer relationship management tools, and workforce management systems, enabling real-time data flow and providing a unified view of your operations. This connectivity eliminates silos, reduces manual processes, and allows your business to focus on growth with a fully connected technology ecosystem.

5. Manual Processes are Draining Time and Resources

If your team is increasingly relying on spreadsheets for financial reporting and forecasting, your current accounting software is no longer meeting your needs. Manual data entry, a common workaround for QuickBooks’ limitations, often leads to inconsistent records and errors that require additional time to resolve. This inefficiency means your staff spends excessive hours reconciling discrepancies and transferring data between disconnected systems instead of focusing on higher-value tasks that drive your business forward.

An ERP system can eliminate these time-consuming manual processes by automating data entry. With real-time data synchronization and centralized workflows, systems like Sage 100 reduce the risk of human error and certify consistency across your operations. An upgraded accounting system can also automate approval processes for purchases or expenses, eliminating the need for paper trails and manual signatures.

You’ve Outgrown QuickBooks – What Now?

Outgrowing QuickBooks is an inevitable milestone for growing businesses, and it’s actually a sign of success. It means your organization has expanded beyond what basic accounting software, spreadsheets, and whiteboards can manage. Upgrading to an ERP system provides transformative benefits, such as integrating all your business processes into a single platform for improved accuracy and efficiency. By automating manual tasks like data entry, reporting, and inventory tracking, an enterprise-level solution saves time and reduces errors. Additionally, these systems offer real-time insight into financial performance, scalability for future growth, and tools to simplify compliance with industry regulations. With an ERP, your business can eliminate inefficiencies, enhance decision-making, and position itself for continued success.

Ready to make the switch? SWK Technologies is here to help you transition from QuickBooks to a true ERP. Our team of expert consultants will guide you through selecting and implementing the right solution. Contact us today to schedule a consultation and learn how we can help you take your business operations to the next level.