This blog originally appeared on Dynamic Tech Services – click here to see the original.

Acumatica allows you to define your specific period-end and year-end closing procedures for every end-of-month (EOM), end-of-quarter (EOQ), end-of-year (EOY), or other financial period end. The guide below will walk you through each step for performing a close-out of these periods after you have defined them in your enterprise accounting software.

Please contact our support team at acumaticasupport@swktech.com if you need additional help with period or year-end close processes, or anything else related to your ERP environment.

Period-End Closing Procedures

Acumatica Cloud ERP provides multiple options to let you configure period-closing procedures in accordance with your company policies.

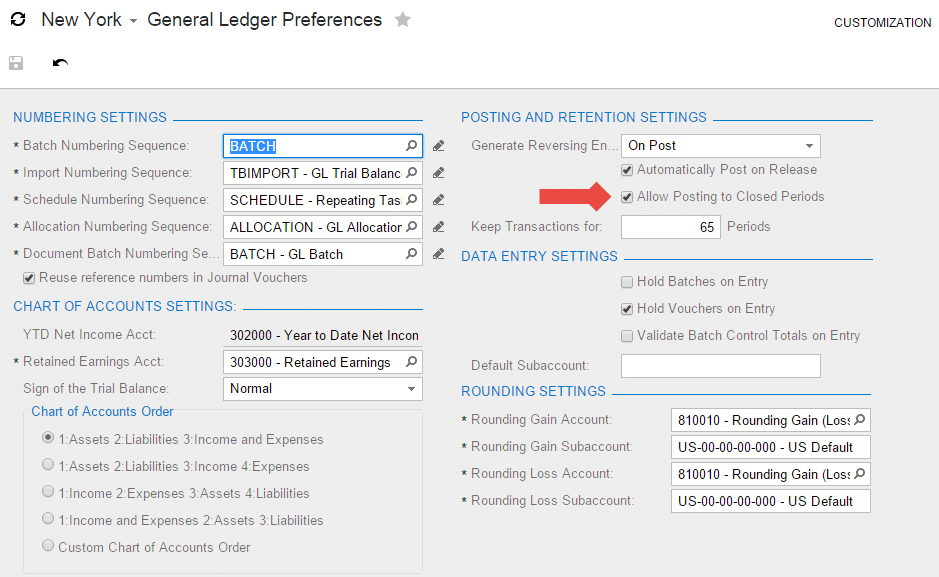

Employees at your company can decide when to perform period-end closing procedures. You do not need to postpone period-end closing to allow recording of certain transactions dated in the period to be closed. Posting transactions to closed periods is possible if the Allow Posting to Closed Periods option on the General Ledger Preferences (GL.10.20.00) form is selected.

At any point in time, you can have multiple active periods. Activating a period doesn’t require closing a previous one.

Period-End Closing

Follow your company’s internal procedures to determine the prerequisites to closing a financial period. Your company might require the following tasks to be completed before a period is closed:

- Performing allocations

- Generating recurring documents and releasing them

- Performing revaluation of foreign currency accounts

- Generating and reviewing the trial balance

To close a period in General Ledger, you first must perform the closing operations in the subledger modules you are using. These include the following:

- Accounts Receivable

- Accounts Payable

- Cash Management

- Inventory

- Fixed Assets

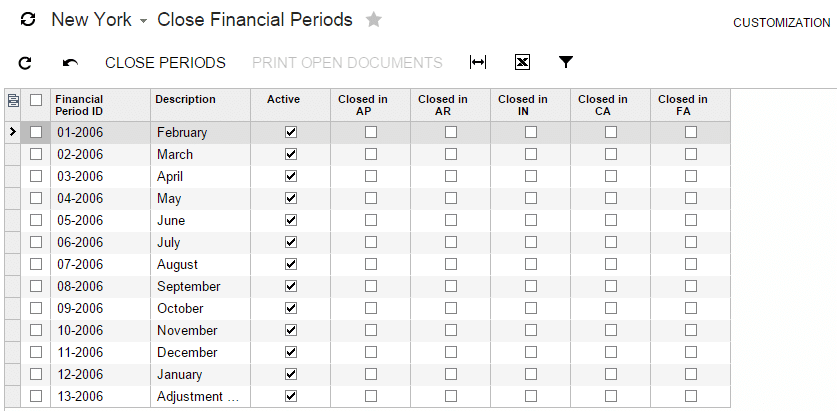

A period is considered closed only when it has been closed in the General Ledger module by using the Close Financial Periods (GL.50.30.00) form. This form gives you information about the status of periods in the Accounts Payable, Accounts Receivable, Cash Management, Inventory, and Fixed Assets modules. If a period has not been closed in any of the modules, you can close it there.

Closing a period in General Ledger initiates generation of auto-reversing batches if the Generate Auto-Reversing Entries on Period Closing is selected on the General Ledger Preferences form. You should never close the last activated financial period; always activate one or more financial periods before you close a period.

Closing a Period in a Subledger Module

A financial period can be closed in the General Ledger module only if it has been closed in the Accounts Payable, Accounts Receivable, Cash Management, Inventory, and Fixed Assets modules. You need to perform the closing procedure in only the subledger modules that are activated in your system.

A period can be closed in Accounts Payable, Accounts Receivable, Cash Management, Inventory, and Fixed Assets only if in the module there are no documents with Released (Unposted), Balanced, or On Hold status that are to be posted to this period.

- To close a period in Accounts Payable, use the Close Financial Periods (AP.50.60.00) form.

- To close a period in Accounts Receivable, use the Close Financial Periods (AR.50.90.00) form.

- To close a period in the Cash Management module, use the Close Financial Periods (CA.50.60.00) form.

- To close a period in the Inventory module, use the Close Financial Periods (IN.50.90.00) form.

- To close a period in the Fixed Assets module, use the Close Financial Periods (FA.50.90.00) form.

When you close a given financial period, all preceding active periods will be closed as well.

If, during the initial stage of using Acumatica ERP, you decided to add one or more periods before the first financial period, you can activate those periods (even if you have one or more closed periods) and post the required transactions to them. Later, to be able to close any of the later periods, you should close those periods first.

Year-End Closing

In Acumatica ERP, year-end closing is performed automatically when you close the last period of the financial year. Thus, closing the last period of the financial year should be done only when the company is ready to close the General Ledger financial year. Period-end closing for the last period of the financial year must be completed in all other active modules before users can perform year-end closing in the General Ledger module.

The year-end closing may include the following stages:

- At the end of the financial year, generating periods for the new year and activating at least one of them

- Carrying out the operations according to your company’s “year-end“ checklist

- Closing the last period in General Ledger and fulfilling all the requirements

During closing of the financial year, the balance of YTD Net Income account updates the Retained Earnings account, which accumulates the net income over years. After that, the balance of the YTD Net Income account is reset to zero for a new financial year. The balances of the balance sheet accounts are simply transferred into the new financial year, while balances of other accounts are reset to zeros.

Get More Acumatica End of Year Resources & Support from SWK

SWK Technologies is an award-wining Acumatica partner and value-added reseller (VAR), with multiple support and development experts at our disposal that will help you build the cloud technology stack that returns the best value for you. For more End of Year resources, education and guidance, reach out to us and get access to the knowledge you need to enable your team’s success.

Contact SWK today to learn more about our Acumatica support resources and experience, and discover how we can enhance the value of your Acumatica implementation.