Financials and Extended Accounting

Acumatica Accounts Receivable

Home » ERP Resources » Acumatica Resources » Acumatica Accounts Receivable

With the Accounts Receivable (AR) module, you can generate invoices, send statements, collect and apply payments, verify balances, track commissions, and deliver customer reports. Get comprehensive reporting that’s accessible anywhere, any time. Accounts Receivable is fully integrated with all other Acumatica modules.

KEY FEATURES OF ACCOUNTS RECEIVABLE

- Flexible invoice and statement delivery. Gain greater control over how you create and deliver customer invoices and statements. Format statements for printing, HTML, or PDF delivery. Keep full records for future reference and auditing.

- Recurring billing. Create contract templates to apply and manage a wide range of fees, overage charges, and minimum charge amounts. Specify start and end dates, renewal terms, a billing schedule, and line items. Include billable hours and customer support hours in bills.

- Credit card processing. Accept PCI-compliant credit card payments with the flexibility to handle manual charges, transaction voids, and refunds. View credit card transactions and issue warnings about expiring credit cards. Connect to any bank processing center with included plug-ins—or build your own using our SDK.

- Deferred revenue recognition. Use deferred revenue codes for individual line items at invoicing to support your revenue recognition requirements. Acumatica will recognize the current part of deferred revenue and generate the right transactions.

- Parent-child credit policy. Configure parent-child relationships between the customer accounts that represent your branches or franchises. Manage credit control on the parent account level.

Key Benefits

REDUCE UNCOLLECTIBLE DEBTS

- Use reports and dashboards to spot potential problems

- Keep up with over-limit accounts, aging accounts, and expiring credit cards

WORK THE WAY YOU WANT

- Use sales contracts to bill recurring fees, one-time fees, setup, and overage

STREAMLINE OPERATIONS

- Let all your teams access customer bills and reports through customized workflow and approval processes

REDUCE DATA ENTRY, MINIMIZE ERRORS

- Use predictive entry and flexible screen layouts to reduce time spent entering and fixing data

BOOST CUSTOMER SATISFACTION

- Create HTML, PDF, or Excel documents—and then print or email them to meet client needs

WORK LOCALLY AND GLOBALLY

- Work in multiple currencies

- Use automatic translation to keep thinking in one currency

- Consolidate financial data from multiple locations

Features and Capabilities

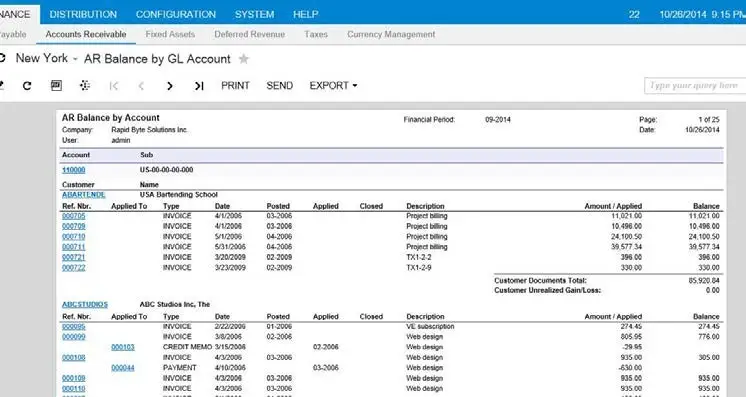

MULTIPLE AR ACCOUNTS IN GL

Map groups of customers to different AR accounts in the general ledger. Override the default AR account during document entry. Acumatica tracks account assignments and applies correct offsets and amounts when payment is applied.

SUPPORT FOR MULTIPLE CURRENCIES

Issue invoices and collect payments in any currency. Acumatica maintains customer balances in foreign and base currency. Automatic currency translation makes real-time adjustments, performs currency triangulation, and computes gain or loss.

AUTOMATED TAX REPORTING

Calculate sales and VAT taxes and prepare for tax filing reports—automatically. Acumatica supports multiple tax items per document line, deduction of tax amount from price, and tax on tax calculations.

CUSTOMER BALANCES AND CREDIT LIMIT VERIFICATION

Enforce credit limits automatically at order entry and at invoicing. Customer configuration options can block invoice processing or issue a warning, create dunning messages for past-due accounts, and temporarily increase credit limits.

PAYMENT REVERSAL AND AUTOMATIC PAYMENT APPLICATION

Apply payments automatically to the oldest outstanding documents. Easily void incorrect payment application—all affected balances will be reversed automatically.

OVERDUE CHARGES CALCULATION

Calculate and apply overdue charges automatically. Compute overdue charges as a percentage or minimum charge amount.

SMALL BALANCES WRITE-OFF

Write off small document balances, controlled by maximum write-off limit and eligible customers list.

CUSTOMER ACCOUNT SECURITY

Specify which individuals and roles can view and modify customer account information and balances.

AUDIT TRAILS

Get a complete audit trail of all transactions. Correct errors by reversing fully documented entries. The system tracks user IDs for all transactions and modifications. Notes and supporting electronic documents are attached directly to the transactions.