Financials and Extended Accounting

Acumatica Fixed Assets

Home » ERP Resources » Acumatica Resources » Fixed Assets

Maintain complete visibility of your fixed assets and depreciation calculations. Fixed Asset Management maintains depreciation schedules for assets that you own, rent, or lease, and is fully integrated with all other financial modules. You can add fixed assets directly from AP purchases, import them, or add them individually—and track tax and reporting scenarios independent of general ledger postings.

KEY FEATURES OF FIXED ASSET MANAGEMENT

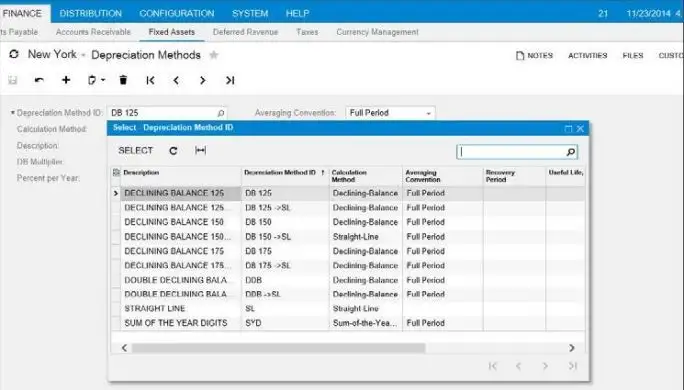

- Multiple depreciation methods. Choose from a large inventory of predefined depreciation schedules or create your own. Accommodate accelerated cost recovery system (ACRS), modified ACRS, straight-line, declining-balance, sum of years’ digits, remaining value, flat rate, units of production, and other methods. Each depreciation method can include different averaging conventions as well as useful life and recovery periods.

- Tax benefit s Take advantage of multiple depreciation books, multiple calendars, special depreciation bonuses, and tax benefit recapture capabilities to comply with complex tax rules.

- Purchase order integration. Convert purchases into fixed assets without re- entering data. Eligible purchases are automatically displayed to simplify the conversion process

Key Benefits

MANAGE THE ENTIRE ASSET LIFECYCLE

- Account for assets from the time they are acquired until disposal

- Enter asset information only once since assets are shared by all modules and reports

CUSTOMIZE FOR YOUR COMPLIANCE NEEDS

- Configure depreciation schedules with a predefined method, averaging convention, useful economic life, and recovery period

- Create your own schedule if needed

SAVE TIME WITH AUTOMATION

- Automate entry, depreciation schedules, and workflow

- Keep accumulated depreciation, asset values, and asset class balance reports up to date

MAKE FASTER DECISIONS

- Get instant access to past information through reports and dashboards

- Gain insights into future needs to improve business decisions

- Use included reports or design your own

Features and Capabilities

MULTIPLE DEPRECIATION BOOK

MULTIPLE ASSET TYPES

Manage multiple property types, including owned property, leases, rentals, and granted property. Track assets that are leased or rented to others.

MULTIPLE AVERAGING OPTIONS

FIXED ASSET TOOLS

Make mass changes to several fixed assets with one entry. Tools include depreciation schedule processing, releasing fixed asset transactions, converting purchases to fixed assets, and generating fixed asset calendars.