Resource and Project Management

Sage 100 Direct Deposit

Home » ERP Resources » Sage 100 Resources » Sage 100 Direct Deposit

Direct Deposit*

Direct deposit is the safe, easy, and cost-effective way for your employees to have their paychecks deposited into their checking or savings accounts. Add Direct Deposit to your Sage 100 ERP (formerly Sage ERP MAS 90 and 200) and you can improve employee satisfaction and save time, money, and the environment by going paperless. Save the cost of printing, storing, and securing your preprinted check forms. You’ll reduce the time and cost associated for your employees to process and print checks and for the receiving employees to physically take those printed checks and deposit them into their checking or savings accounts.

Direct Deposit processes employee paychecks and produces an ACH (Automated Clearing House) file to be routed to the specified financial institution—without printing a check. So instead of having to take the time to run to the bank themselves, wait in long lines, and wait for the check to clear, your employees will see the money in their accounts on payday. They will also be able to choose to split disbursements between multiple accounts, such as savings and checking, and different institutions based on fixed dollar amounts or percentages.

Best of all, this dynamic solution is easy to install and operate. It makes adding direct deposit functionality to your payroll software an affordable and convenient way to make life simpler for your employees. After Sage 100 ERP produces the ACH file, it is securely and easily sent to your company’s financial institution, as long as that financial institution conforms to National Automated Clearing House Association (NACHA) standards. In turn, money is withdrawn and wired directly into the employee’s account.

*This module is compatible with Sage 100 Standard and Advanced ERP.

Benefits

- Process payroll without the paper— save time, money, and the environment

- Increase efficiencies by electronically routing to the specified financial institution

- Reduce the risk of fraud and conform to NACHA standards

- Provide convenient payroll disbursements more quickly to your employees

- Allow your employees to allocate by percentage or amount to multiple accounts

Edition

Compatible with Sage 100 Standard and Advanced ERP

Features

FLEXIBLE DISBURSEMENTS

COMPLETE ELECTRONIC PAYROLL PROCESSING

Direct Deposit generates entries, processes your employee paychecks, and produces an ACH file to be routed to your specified financial institution. These ACH files follow the NACHA standards and are configurable based on the requirements of your financial institution, as long as that financial institution also follows NACHA standards. Batch ACH files are created that, if necessary, can be regenerated at a later time. A prenotification file is also generated for submission to your financial institution for approval.

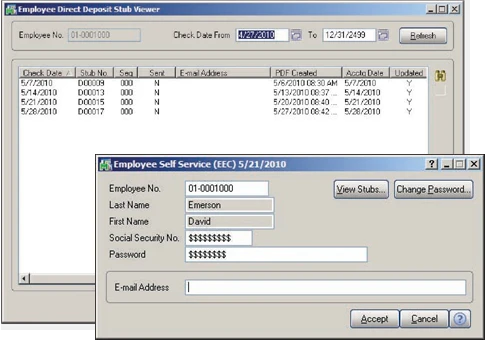

SELF-SERVICE VIEWER

Deposit information such as date and net payment amount can be confirmed by your employees’ using the self-service viewer.

REDUCE THE RISK OF FRAUD

Unlike printed checks that can be stolen, altered, and duplicated, direct deposits are done electronically and have many layers of security. Direct Deposit is sent directly to the financial institution through ACH transactions and does not pass through many hands before being deposited or cashed by your employee.

About Sage

Sage is a leading global supplier of business management software and services for small and midsized businesses. The Sage Group plc, formed in 1981, was floated on the London Stock Exchange in 1989 and now employs more than 12,300 people and supports more than 6 million customers worldwide. For more information about Sage in North America, please visit the company website at www.SageNorthAmerica.com. Follow Sage North America on Facebook, https://www.facebook.com/SageNorthAmerica, and Twitter, https://twitter.com/#!/sagenamerica.

Want More Information on Resource and Project Management?

Lead your company to increased efficiency and profitability. Have a complete solution for fully supporting one of your most vital assets: Your employees.