Core Accounting and Financials

Sage 100 Federal and State eFiling and Reporting

Home » ERP Resources » Sage 100 Resources » Sage 100 Federal and State eFiling and Reporting

Federal and State eFiling and Reporting*

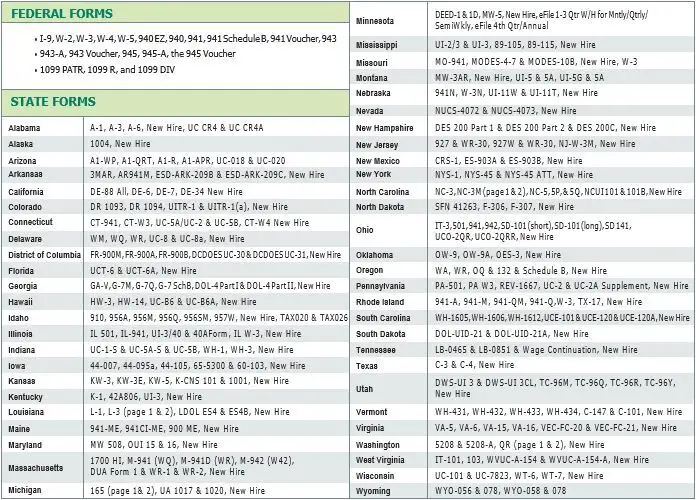

Streamline your tax reporting processes with Sage 100 ERP (formerly Sage ERP MAS 90, 200, and 200 SQL) Federal and State eFiling and Reporting module capabilities. Eliminate manual form creation and save time by choosing from over 250 federal and state forms for Unemployment, Withholding, New Hire reports, W-2s, W-3s, and 1099s.

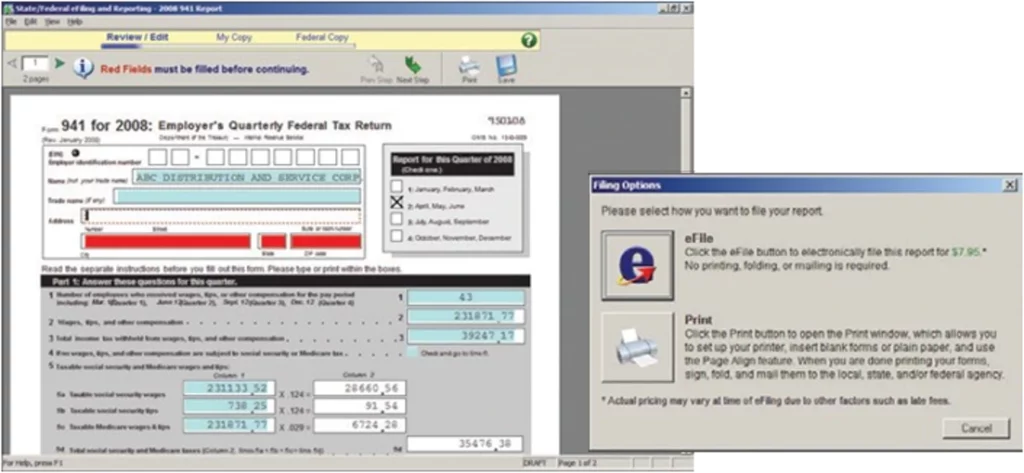

With Sage 100 ERP Federal and State eFiling and Reporting, you can print and mail the provided federal and state forms. The electronic forms have a familiar appearance, as they are a replica of the government forms you would receive in the mail. The electronic forms that appear on your screen aren’t blank, however—much of the information is already filled out for you by your Sage 100 ERP system. View and edit the information easily on your screen, and once you’ve

verified it’s the way you want it, the form is ready to print or e-file. If you choose to print the form, you can utilize blank, perforated W-2 and 1099 forms, available for purchase from Sage Checks & Forms, without having to align preprinted forms. Many state forms, such as Withholding and Unemployment, allow you to print on blank paper and don’t require the purchase of any preprinted forms.

Go completely green by utilizing our eFiling Service, offered on a transaction-fee basis, to further streamline and simplify your tax reporting process. You choose how much of the service to utilize, from efficient filing of employee New Hire or Unemployment forms to a complete filing service for W-2s and 1099s, with hard copies sent to your employees and to you for your records. You can also provide your employees with immediate access to their copy on a secure website. You only incur fees for the forms you choose to e-file. No sign-up fees, and no subscription fees.

You’ll always be in compliance with our automated form updates. And every report is saved in its own history file for easy retrieval to reprint, edit, or e-file. Use Federal and State eFiling and Reporting to save significant time so you can focus on other important areas of your business.

*This module is compatible with Sage 100 Standard, Advanced, and Premium ERP.

After you select the form you want to use, your system automatically fills out your electronic form. During your preview process, the system identifies information by highlighting the field in red. Once your form is complete and ready to file, simply choose eFile or Print options.

Edition

Compatible with Sage 100 Standard, Advanced, and Premium ERP

Benefits

Go green—save time, money, and the environment by utilizing over 250 federal and state e-forms

Eliminate manual report creation and the need to handle, align, and store preprinted forms

Minimize data entry errors—populates from your Sage 100 ERP employee and vendor data

Increase productivity by autogenerating a completed form that’s ready to print, sign, and send—or e-file to save paper, postage, and time

Always stay in compliance with the latest quarterly form updates

Access archives for historical filing information of every completed form

Features

ELIMINATE MANUAL EFFORTS

AUTOMATICALLY COMPLETE FORMS

E-FILE FORMS AND PAYMENTS

Choose the level of e-filing services you want to use for your W-2s and 1099s. We offer two types— Basic and Complete. Both save you time on requesting, stocking, and finding the forms you need. Basic service provides you with the ability to send state or federal reports through e-file in minutes. Complete service files your federal and state forms electronically, and also prints, stuffs, and mails your employee copy; plus, a plain-paper copy is provided for your records.

Want More Core Accounting and Financials Information?

Experience the depth, functionality, and ease of use that Sage ERP offers. Provide an accounting foundation for your business that optimizes your productivity.