Core Accounting and Financials

Sage 100 Fixed Assets

Home » ERP Resources » Sage 100 Resources » Sage 100 Fixed Assets

Fixed Assets*

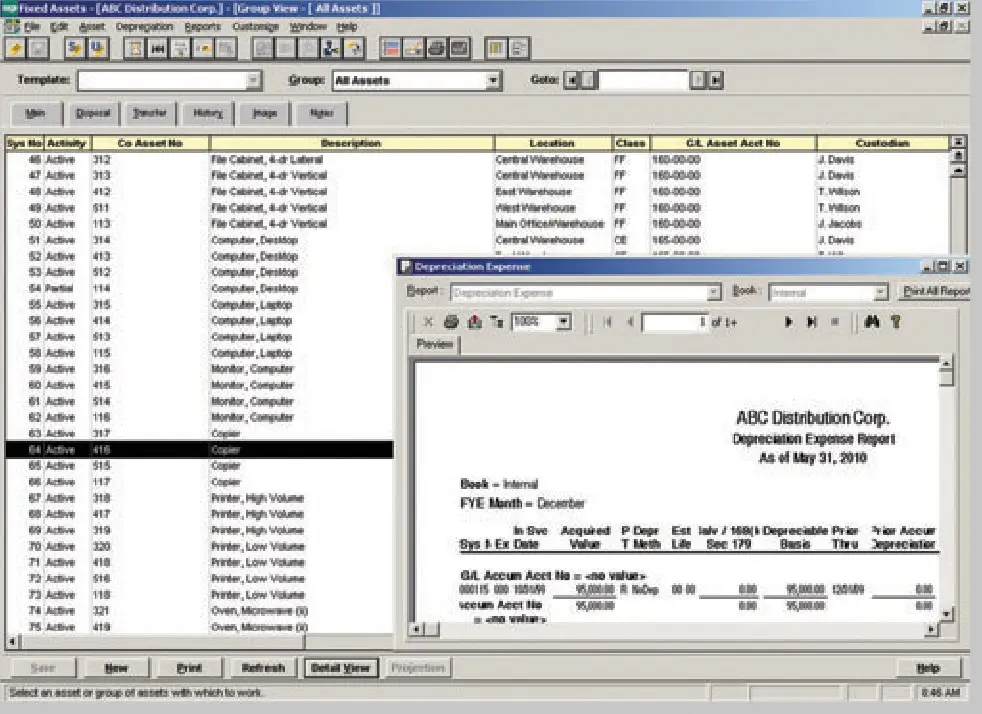

Manage your fixed assets effectively from acquisition to disposal, account for their value, and reap tax benefits whether you have a fixed asset inventory of 10 or 1,500. The Sage 100 ERP (formerly Sage ERP MAS 90 and 200) system offers Fixed Assets—designed to meet the needs of small and midsized businesses, providing you with fast, dependable, customizable fixed asset management to maximize your bottom line. Fixed Assets combines acknowledged depreciation expertise and user friendliness with the added power, data security, and functionality that your business situation demands.

Run projection depreciation calculations, create IRS-ready depreciation tax forms, and move fixed assets between business units with ease. Fixed Assets provides you with the additional ability to execute partial and whole transfers and disposals, conduct bulk disposals with automatic gain/loss calculations, and track transfer activity with as little as a single keystroke.

You also get extra security features at the system level, company level, and user-defined menu levels, such as complete audit histories on all changes made to the fixed asset system. In addition, SmartLists provide user-defined values for each asset descriptor, ensuring a high level of consistency throughout the asset system. Easy to install, customize, and use, the Fixed Assets module is a comprehensive solution within your Sage 100 ERP system.

Easy to install, customize, and use, the Fixed Assets module is a comprehensive fixed asset management solution.

Discover more about Sage Fixed Assets software

Edition

Compatible with Sage 100 Standard and Advanced ERP

Comprehensive Features

Complete fixed asset accounting and depreciation for better business management and compliance

Over 300,000 IRS and GAAP rules built in

Seven books—all visible on one screen:

- Internal

- Tax

- ACE

- AMT

- State

- Two user-definable books

Automatic creation of AMT and ACE schedules and over 50 methods of depreciation, including:

- MACRS 150% and 200% (formulas and tables)

- ACRS

- Straight Line

- Modified Straight Line (formulas and tables)

- Declining Balance

- Sum-of-the-Years-Digits

- Customized depreciation methods

Features

TRANSFERS AND DISPOSALS

GROUP MANAGER

ASSET TEMPLATES

ASSET VIEWS

ASSET NAVIGATION AND HISTORY

REPORTING AND TAX FORMS

ONLINE HELP

Instant, context-sensitive online Help is always available to you. Also, customizable Help for online corporate guidelines can be easily added.

EXTRA SECURITY

Ensure complete security at user, user-defined menu, system, and company levels to protect important or proprietary data from unauthorized access or manipulation.

Benefits

COMPLIANCE

EASY TO USE

Want More Core Accounting and Financials Information?

Experience the depth, functionality, and ease of use that Sage ERP offers. Provide an accounting foundation for your business that optimizes your productivity.