In this webinar, Bruce Kern from SWK Technologies provided a comprehensive overview of the Purchase Order (P/O) Landed Costs feature in Sage 100 and demonstrated how businesses can enhance their cost tracking by allocating freight, duties, and other expenses to inventory items. This feature makes profitability analysis and expense control more accurate.

Whether you are currently using Sage 100 for inventory management or looking for ways to improve your cost allocation processes, this session explored practical strategies to implement the landed costs feature, including how to set up, configure, and use it within purchase orders and item screens. Bruce’s demonstration covered the step-by-step process, from initial setup to final inventory postings, giving a full understanding of how to leverage the P/O Landed Costs functionality for your business.

Watch the Webinar Here

Recap of the Webinar

Use this recap to skip to the sections that matter to you:

Understanding the Importance of P/O Landed Costs (1:00 – 4:45)

Bruce kicked off the session by diving into the basics of P/O landed costs, a feature in Sage 100 that helps businesses allocate additional expenses to their inventory items. He reviewed how the functionality provides a clearer picture of true costs and profitability, enabling companies to maintain tighter control over their expenses and make more informed financial decisions.

- Landed costs include additional expenses such as freight, duties, and insurance that go beyond the purchase price of an item (1:20)

- Incorporating landed costs provides a more accurate total cost of goods and improves profitability tracking (1:49)

- The matching principle is a concept that accounts costs like shipping and duties in the same reporting period as revenue (2:33)

- Including landed costs in inventory values prevents unanticipated reductions in profit margins when items are sold (3:20)

Setting Up Landed Costs in Sage 100 Demonstration (4:59 – 10:59)

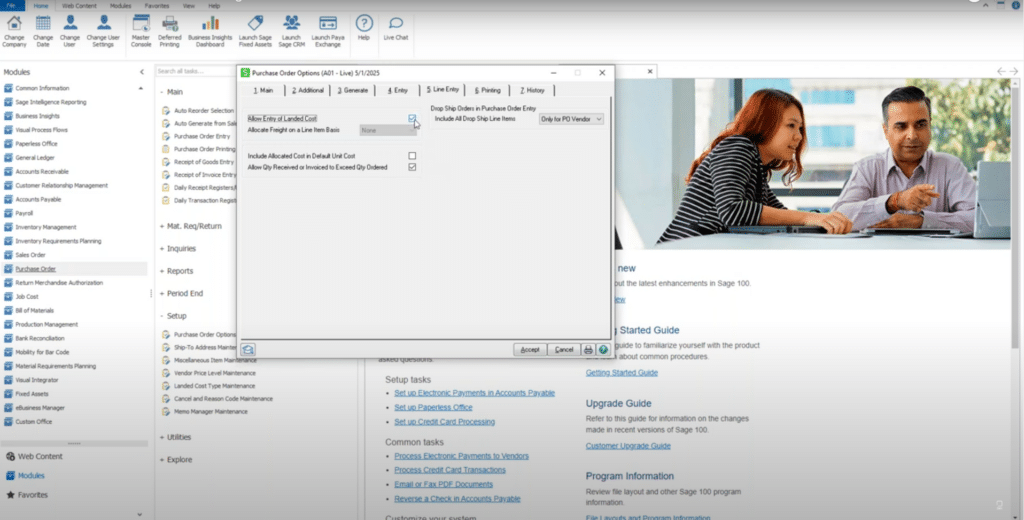

In this segment, Bruce walks through the process of setting up the Purchase Order landed costs in Sage 100. This step-by-step guide highlights where to enable the landed cost feature and how to configure it for accurate cost allocations.

- Enabling Landed Costs: The Purchase Order Options screen contains a simple checkbox under the line entry tab that enables the landed cost feature. Once activated, it allows users to allocate costs like freight and duties to inventory items (5:10)

- Allocate Freight on a Line-Item Basis Option: Sage 100 includes an alternative freight allocation feature, but it only supports one calculation method and requires an invoice, making it less flexible compared to the landed costs feature (5:49)

- Default Unit Costs: It’s possible to configure the system to include allocated costs in the default unit cost. (6:26)

- Detailed Cost Tracking: The option to print landed cost allocation details in the number six tab ensures that businesses can review all cost calculations during the receipt of goods process (6:55)

- Managing Landed Cost Types: Sage 100 allows users to create and maintain multiple landed cost types, such as freight, duty, or handling fees. Each type can have its own calculation method, including weight, cost, volume, or quantity (7:31)

- GL Account Linking: Each landed cost type must be linked to the correct General Ledger account, which allows accurate tracking and allocation of associated expenses, such as freight and duties (8:55)

Tip: The Inventory Management module must be integrated with the Purchase Order module to use landed costs in Sage 100. Make sure this integration is in place before setting up landed cost types.

P/O Landed Costs in Action (11:00 – 22:59)

Bruce provides a step-by-step demonstration of how to create a purchase order, receive goods, and allocate landed costs. This segment offers practical insights into how landed costs affect total item costs and inventory value in Sage 100.

- Setting Up Landed Cost Types: Multiple landed cost types, such as duty and third-party freight (ex. UPS), can be created in Sage 100. Each cost type can be assigned its own General Ledger account and allocation method (weight, cost, volume, or quantity), offering flexibility for different types of costs (11:06)

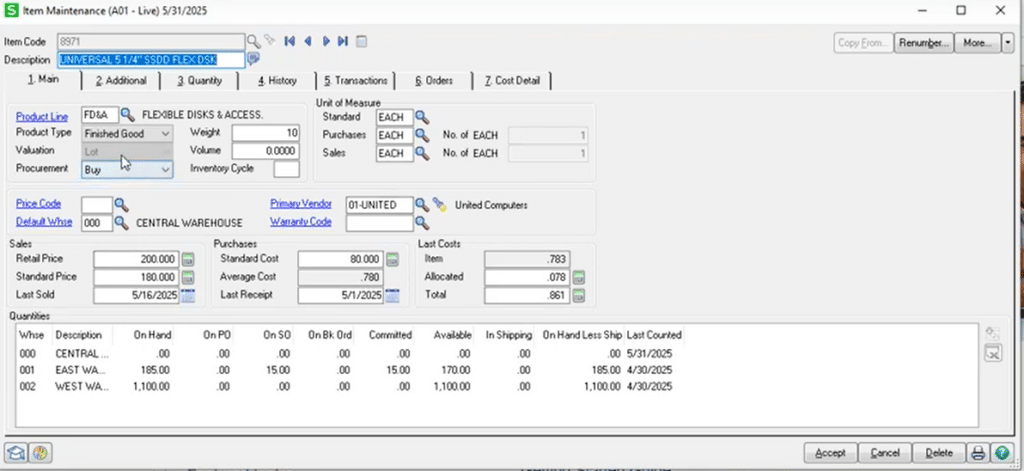

- Inventory Item Preparation: To use landed costs with inventory items, each item must have the “allocate landed cost” checkbox selected. This can be done on an individual item level or set as a default within product lines (11:51)

- Costing Methods: Different inventory costing methods, including Lot, FIFO, LIFO, and serial, work well with landed costs, as they provide accurate visibility into cost allocations. However, standard costing is less ideal since it doesn’t reflect actual landed costs, while average costing can blur the current cost with allocations (13:33)

- Creating a Purchase Order: In the purchase order entry, under the lines tab, items selected for landed cost allocation will show up with a corresponding “LC” checkbox. Sage 100 allows users to allocate costs based on weight, ensuring the landed costs are spread proportionally across all items on the order (16:02)

- Receiving Goods: Once goods are received, the landed cost allocation can be applied, even if the invoice is not yet available. Sage 100 provides flexibility in this regard, allowing users to estimate costs and apply them during the goods receipt process (18:35)

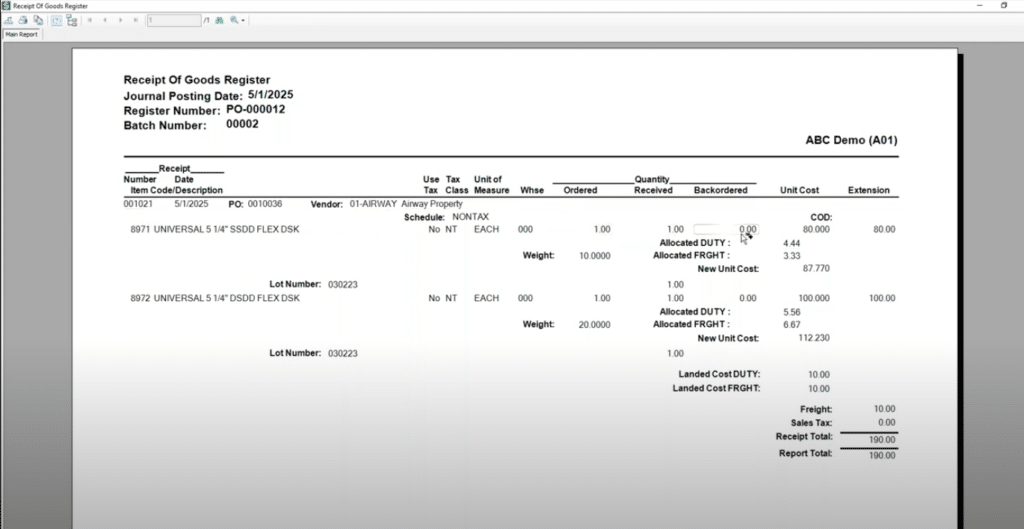

- Allocating Landed Costs: After receiving goods, users can select and apply the appropriate landed cost types, such as freight and duty. The system will allocate these costs based on the chosen method (e.g., weight or cost) across all items on the purchase order (20:49)

- Final Review of Landed Costs: Once landed costs are applied, the system provides a summary of the total landed costs, including any freight and duties allocated (21:45)

Tip: Sage 100 offers four allocation methods for landed costs: Quantity, Weight, Cost, and Volume—giving users flexibility in how they allocate expenses to inventory.

Financial Impact of Landed Costs (23:00 – 29:45)

This section explored how landed costs flow through the system and affect financial statements. Bruce discussed the impact on inventory and expense accounts, helping attendees understand the financial implications of using this feature.

- Proportional Allocation of Landed Costs: When landed costs such as freight and duties are applied, Sage 100 allocates these expenses proportionally based on criteria like weight or cost. This ensures the true cost of each item is reflected in the system, providing more accurate inventory valuations. (23:15)

- Visibility of Cost Allocation: After applying landed costs, Sage 100 displays a breakdown of how costs were distributed across inventory items. This helps users understand the exact impact on individual item costs, providing transparency in cost distribution. (24:09)

- GL Posting and Financial Updates: Once landed costs are allocated, they are posted to the General Ledger in real time. This ensures that both inventory and financial accounts are accurately updated, reflecting the true costs of acquiring and storing goods. (25:28)

- Detailed Landed Cost Reporting: Users can generate detailed reports in Sage 100 that show the allocated landed costs, including amounts for freight and duties. This report provides clarity on the total cost of goods and enhances financial tracking for better decision-making. (28:44)

Tip: The Inventory and GL accounts will reflect the item cost plus allocated landed costs. Be sure to review your GL postings after applying landed costs.

Real-World Use Cases and Scenarios (28:58 – 36:10)

Bruce shares examples of how businesses benefit from using landed costs in Sage 100, particularly when dealing with multiple shipments, different freight carriers, and separate invoicing for materials and freight.

- Evaluating Landed Cost Allocations: When applying landed costs, businesses should periodically assess whether the allocations accurately reflect the true expenses. If freight or duty costs are over-allocated, inventory costs might be overstated, affecting financial performance (30:06)

- Reviewing Freight Expense: By analyzing the GL freight expense account, businesses can determine whether allocations are correctly offsetting the freight expense. This helps to avoid situations where freight expenses impact the bottom line without being reflected in the cost of goods sold (31:23)

- Invoicing Impact on Profitability: When an invoice is generated, the system calculates the cost of goods sold, factoring in all landed costs. This makes sure that transportation costs like freight and duties are included in the cost of the items, providing a more accurate gross profit margin (34:23)

Tip: Sage 100 allows users to prepay freight expenses and allocate them to inventory.

Q&A Session (36:19 – 49:50)

- Will P/O Landed Costs work with item unit of measure conversion? (36:49)

- Yes, Sage 100 handles unit of measure conversions seamlessly, allowing landed costs to be applied accurately, even with different units involved

- Is there a limit to the number of landed costs types you can create? (37:59)

- No, there is no practical limit to the number of landed cost types you can create in Sage 100

- What if a freight carrier invoice is sperate from a material invoice and it comes in much later? (38:53)

- You can allocate landed costs based on estimates and apply the freight carrier invoice later, so freight expenses are accounted for accurately

- How does this work if there are multiple receipts on the same P/O? (41:10)

- Landed costs can be allocated across multiple receipts for a single purchase order. Allocations should be adjusted to match the quantity received in each shipment

- Can freight costs be allocated at the time of P/O invoicing instead of at the receipt of goods? (42:16)

- No, landed costs are allocated at the receipt of goods. However, if the invoice is available at the time of receipt, actual values can be entered

- Can you add HTC codes to items and automatically assign the duty percentage? (43:22)

- No, while HTC codes can be stored, there is no built-in functionality to automatically apply duty percentages based on these codes

- Is there any way to allocate freight across multiple P/O’s without doing it manually? (45:32)

- No, the allocation process is specific to each purchase order, so freight costs need to be assigned manually for each P/O

- Could this be done at the receipt of invoice versus the receipt of goods? (45:57)

- No, the landed cost feature in Sage 100 is designed to work with the receipt of goods, not the receipt of the invoice

- Can you assign different GL codes for landed costs expensed to different items? (46:42)

- No, the GL codes for landed costs are assigned at the landed cost type level, not the individual item level

- Will this integrate well with Scanco? (48:27)

- Yes, the landed cost feature should work with Scanco and similar third-party warehouse automation tools, though it’s recommended to confirm compatibility based on specific versions

Learn More About Integrating Sage 100 for Better Cost Management

Managing your inventory costs more effectively is possible with the flexibility of Sage 100’s landed costs feature. Allocating expenses like freight and duties can enhance profitability tracking and give you a clearer view of true product costs.

SWK Technologies, a Sage Platinum Club member and Sage Diamond Partner, offers integration services for Sage 100 and scalable cloud hosting solutions. With our award-winning team, we’ll help make sure your ERP system is fully aligned with your business goals.

Ready to get started? Contact us today to explore how Sage 100 can integrate seamlessly into your operations.