Year-end operations don’t have to be a hassle! Our Sage 100 Consultants have hosted a year-end processing and closing procedures Sage 100 workshop to ensure your team is ready to take on year-end 2020 with confidence. Learn how to get the most out of distribution and financial modules in this helpful Sage 100cloud workshop tutorial by SWK SVP of STAT, Merilyn Van Zwieten:

Sage 100 – Year-End Processing and Closing Procedures in Sage 100 Workshop Transcript

Each year SWK has a webinar on Year End Closing that goes through the procedures recommended by Sage Software. The procedures provide a careful approach to the mechanics of year end processing. Our webinar from 2019 is on our YouTube channel and you may want to look that up as a compliment to this webinar. It has an excellent slide deck of the concepts we are reviewing today along with some explanations of the Sage environment. I want to look beyond the mechanics and share some of my opinions and observations after 30 years of helping clients with Sage 100. We will be focusing on the distribution and financial modules. In this video, we are looking at Sage 100 version 2020, subscription. Your version may be slightly different, but most of the concepts will be the same.

Think of Period End and Year End processing like you do maintaining your car. You change the oil to extend the life of the car and you wash it for a better user experience. I think maintaining your software certainly provides a better user experience and perhaps you will uncover functionality you did know you had thus, getting more out of the software you already own. Most but not all modules require a Period End process and a general rule of thumb is that you start at the bottom of your module list and begin the process of closing the year, module by module. Of course, there are exceptions. I believe there is more to think about with each module than just task of running Period End processing. Closing the year or period does not run utilities that repair data. But rather it does two things. First, it purges older data based on your settings in the module’s Options. And second, it stops users from back dating transactions that impact reporting.

If some of you have not been closing periods and years on a regular basis, let me provide a few more reasons to do so:

- When report based on periods are run, some will default to the period displayed in the Options for that module. If you haven’t closed periods/years for a long time, every time you run reports, you must remember to change the period and year.

- Working in General Ledger’s Account Maintenance/Inquire requires a year change every time you want to look something up. That is true in Inventory Maintenance/Inquire too. Save yourself some hassle and keep up with period/year closes. This is also true when you look at transactions in Item Maintenance. The default is the period indicated in Inventory Setup Options. Every time you want to investigate transactions, you must change enter dates.

- There are some Library Master settings you can take advantage of. Restrict accounting date to current plus one future. That refers to the date you select for your default date for the module. The second is document date warning. Nice way to guard against users making typing errors that can make reporting or reconciliations difficult.

PURCHASE ORDER

Before we close the period, let’s consider some of the setup options. There is a history tab where you can choose how long to retain history on items and vendors. You make the choice. I think it makes sense to treat all modules the same way.

The second option to be considered is how long you want to retain completed purchase orders 0-999 days. If you have selected to retain purchase order history the activity is not purged but merely resides in the history files rather than the open purchase order files. By setting the retention for a shorter time keeps the list of the open order smaller and easier to manage when you are working everyday with purchase orders.

I also think that period end is a good time to review open purchase orders. Do you have open purchase orders going back several years? The downside of not addressing the old orders is your summary information in Item Maintenance/Inquiry is not helpful from a purchasing or inventory management standpoint. Many of the PO reports list everything that is included in that open PO file. Too much old stuff makes the reports less convenient to use. Cleaning up old PO’s will certainly improve your data and the user experience!

The Purchases Clearing Report shows the dollar value difference between inventory received and invoices received. The total of the report should equal your balance sheet. It indicates the dollar value of inventory received vs inventory invoiced. The clearing report alerts you to PO lines where the quantity received is different from the quantity invoiced. If there are old PO’s on the report, you have some cleaning up to do! The report can only be run as of the current date so you will compare the total to the general ledger balance of today.

Last, let’s think about the timing of closing the PO module. In my opinion, once all your inventory receipt of goods for a month have been processed, it is time to close. Thus, that will likely be within a day or two of the end of the period. You can receive the invoices of a PO in the month after the receipt of goods as it generates a balance sheet entry. That is why we have a Purchases Clearing account.

The mechanics of closing the module pretty straight forward. The period end processing menu gives us guidance to the tasks Sage Software had envision as being important to run at month end. The Purchases Clearing Report, which we already discussed, is part of the menu.

Next is the period end report selection. If there are any PO reports you would like to run, the selections are made here. If you do not use any of these reports, you may want to remove all the lines. Note that you can select a report setting. I like setting these to run to Paperless Office rather than printing physical copies, but that is up to you.

Select Period End Processing and follow the prompts.

SALES ORDER

Before closing your year look at your sales order options.

- Check the history tab for number of years you want to retain sales history. You may want to have this set to the same number of years selected in the purchase order module.

- Look at your open order list. Do you have old sales orders that will never ship? Consider removing the lines that will never ship, so the sales order completes. If you have a sizable number of old orders, there is a utility to purge them. Make sure to do a trial run in a test company before trying it your live company.

- Are there open sales orders that are recent and need some attention? Are there back orders?

- During the period/year end processing expired repeating and master orders are purged. That is true of the purchase order module.

The period end processing menu does not list any other tasks other than running the period/year end processing and is the same as what we did in purchase order.

When should you run your period end processing? In my opinion, after your last order has been shipped for the month or year it is time to run the process. That would likely be after your last day of the month’s invoice run has been updated.

INVENTORY

Let’s first check out History Retention. It is in Common Information!

Some of you are doing physical inventories on a regular basis. Many more of you are doing this at year end. That task should be completed before closing your period/year. For those of you that do not do a physical at year end you may want to consider at least taking care of your negative quantities on hand. There is a quick way of finding if you have any. Check out the Explore View for Item quantities by Warehouse. I have slightly modified my screen to highlight only negative quantities. According to this list, my inventory is understated. My first check would be any purchase orders that should have been received. Has a receipt of goods entry been missed? At any rate, an adjustment needs to be made to bring the inventory to zero. You can do that by recording the missed ROG, an inventory adjustment or a physical inventory for just these negative quantity items.

In the Period End menu, the first task is the Negative Tier Report. If you are using FIFO or LIFO valuation and an inventory item has been allowed to go negative, Sage creates a special tier called OVERDIST. My report is showing several items that looks a lot like my Explorer view of negative inventory quantities! Once an adjustment has been made, adding the quantities back so the inventory net quantities will be zero. However, a new tier will be created. Running the Negative Tier Report and then Negative Tier Adjustment will offset the positive tier with the OVERDIST tier. If the tiers combined have different values this will create and entry to COGS and Inventory.

Running through the closing task comes after you have updated all your Receipt of Goods, Sales Order invoices, Negative Tiers, Physical inventory or at least correcting negative quantities on hand. Make your selection of reports that you want to run. Consider using Paperless Office. The inventory valuation report should compare to your balance sheet accounts. Remember this report is a contemporaneous report. You cannot run it for a prior date. However, there is an Inventory Valuation Report by Period. I have not always found this report to be accurate. Test yours by running both reports for the current period and see if they compare. As you are closing up your modules, many of the reports will be run before you do the period end close. If that is your habit, don’t run the reports again. Just remove them from your list.

ACCOUNTS RECEIVABLE

Here is one of our exceptions to the rule of closing period starting at the bottom of the list. The reason for the change is the nice utility in Accounts Payable that allows you to offset a vendor invoice with an Accounts Receivable invoice. To use the AR to AP clearing there is a small setup required. See the Vendor to Customer Link in the setup menu. Here you can relate a customer and a vendor. It is not uncommon to have a customer that is also a vendor. By creating the relationship, you can use an AR invoice to offset an AP invoice.

Next, let’s make sure your history retention makes sense. The History Tab is where retention is selected for customer sales, salesperson and cash receipts. On the Additional Tab the number of months to retain paid invoices is selected also when to do the remove invoices from the open invoice file, month end or year end.

This is a good time to reconcile the AR aging report to your balance sheet account not to mention checking the accounts to see if you have some collection activities. Just a quick tip: Run the Daily Transaction Register in General Ledger to make sure there are no unposted register journals.

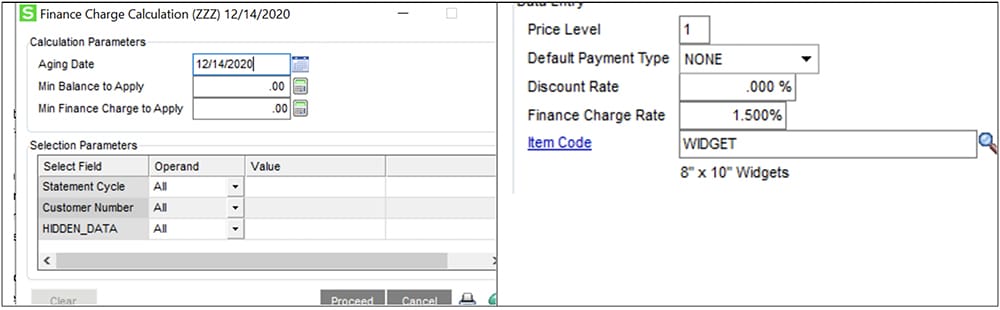

In AR’s Period End Processing menu, we see a lot of tasks. The first task is calculating finance charges. There is some flexibility on what customers will be calculated and you can select the date to compare with invoice due dates. Note that one of the choices is Statement Cycle. The customer master has the cycle field on tab 2. It is one way to separate who you will calculate finance charges for. Also, the Finance charge rate field in customer maintenance needs to have a value too.

By running the Finance Charge Calculation, we get a summary of the past due invoices by customer and a calculation of the finance charge. Update the register and an entry is made on the customer’s account. A printable invoice is not created, only an entry to the account.

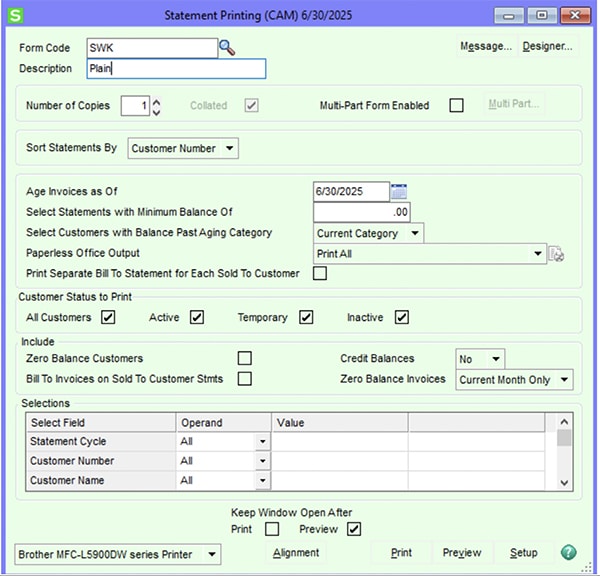

Our next task in our closing process is customer statement printing. This is a perfect opportunity to use Paperless Office. There are some handy options.

You can choose the date you want to age the invoices, select a minimum balance. Selecting the aging category is handy. Then you are only sending statements that need more attention.

Select your Paperless Office options and review the other selections and print away!

I like sending out statements for a few reasons. The first is obvious. Customers receive a nudge to send you money and the second is that I need to constantly pay attention to my customer’s accounts so they receive accurate statements.

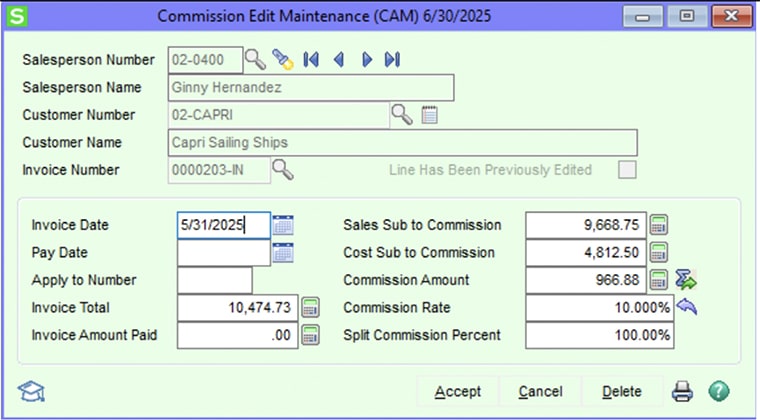

The next items in the list is commission edits. If you have identified an invoice with an incorrect commission calculation you can fix it here.

If the sales or COGS subject to commissions is incorrect, enter the correct information and the commission amount will recalculate once you click the Epsilon icon.

Next task is to update the register and rerun the salesperson’s commission report. You will see the corrected calculation.

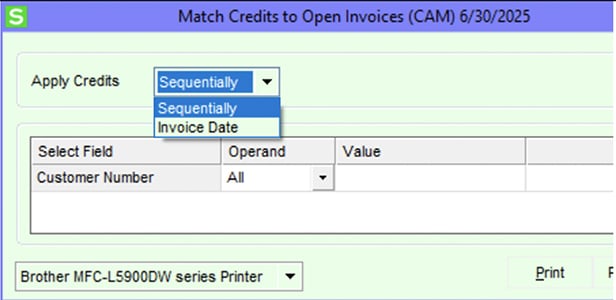

Our next step is a nice utility that will offset open credit memos with open invoices. This can be a time saver. However, you do not have a choice to apply the credits other than sequentially or by invoice date. Try it out in a test company first.

Keep in mind all these tasks are optional. Get in the habit of using what will optimize your system.

Finally, we are ready to select the reports we want for our period/year end close. Setup reports that you will actually use. And then perform the Period End processing.

In my opinion, closing AR and AP will come after you have reconciled your bank. Keeping these modules open till then allows you to easily make corrections on errors found during the reconciliation.

ACCOUNTS PAYABLE

Before moving to Accounts Payable closing menu, check how your history retention is set. Not only do you want to check the History tab for number of years to retain history, but you will want to consider the retention of invoices in the open invoice file. Look at Tab 2 for number of months and when to remove the invoices, month end or period end.

The Period End Processing only has the AP to AR clearing that we have already discussed, so the only task is to close the period.

I think there are a few things to consider before running the close. First, does your Accounts Payable Trial balance compare to the general ledger? Have you paid for invoices on a credit card and have you transfer the balance to your credit card vendor? Are all invoices still valid? I am often helping clients with a review of their payables and hear “oh, we don’t owe that”. If that is true, adjust the invoice off. Also, do you have vendors with open invoices and credits that net to zero? Consider using the APP manual check process to clear out those old transactions.

At year end, 1099’s needs to be considered. Under the AP reports menu, you will find 1099 reporting. This does not need to be done before closing your year, but I think it makes sense. Remember, beginning in 2020 you will report non-employee compensation on form 1099-NEC. There is a utility to transfer your 1099-Misc information to the new form or you can correct the vendor information by hand by clicking on the 1099-History button in vendor maintenance.

What is the timing of closing AP? Whenever you feel that all invoices for the year of been received and your reconciliations are complete, close it up! If you should miss an invoice you can always write a reversing journal to get it into the year.

The mechanics are the same as other modules.

GENERAL LEDGER

The General Ledger module stays open until all your financial transactions have been recorded; Depreciation & amortizations, accruals, reconciliation of your balance sheet accounts. An outside accountant may do some of this for you, but a review of selected financial statements should be considered.

- Running the Income Statement Trend report will help you identify problems in your financial data. Let me show you how to run that type of financial report.

- Update your budget for the new year. Tomorrow we are having a detailed webinar on this topic. I encourage you to attend as there are many options within the standard functionality of Sage 100 budgets.

- Run your balance sheet. There are several key accounts that you can reconcile;

- Cash

- Accounts Receivable

- Accounts Payable

- Purchases Clearing

- Inventory

- Fixed Assets

- Other significant accounts

- Make sure the Daily Transaction Register is empty.

- Run the General Ledger Detail report. Do all the entries look like they are in the correct account?

- If you have recurring journals setup, make sure to run them.

- Enter your Auditor’s journals.

It is time to close the period. Under the Period End menu there is the option to run the allocation journals. My recommendation would be to run these before you have your final review of your statements and other reports rather than running just before closing the period.

When is it time to close? Once you are ready to turn it over for tax preparation or have provided financial statements to individuals inside and outside the organization where they have the expectation that they have received your final numbers. How to close? Just like all the other modules.

CONCLUSION

As you can see the mechanics of closing years and periods is straight forward. But it takes time to make sure your data is meaningful. Review the recommendations presented today along with those in our 2019 webinar. Determine what you believe will help your business and make a habit of keeping your Sage 100 in the best shape possible.

Hope you have found this information useful. I will turn the webinar back to Jolene and will answer any questions submitted.

Stay Up on the Latest Sage 100 News with SWK Technologies

SWK delivers the latest news, updates, and tips & tricks for Sage 100 and Sage 100cloud users to help them capture the most value from their software. View any of our Sage 100 video resources to learn more about what your Sage ERP can actually do.Contact us if you have any questions on how to best use your Sage 100 or Sage 100cloud software.