Bastian Boesner-Worth

Practice Director – Sage Intacct

SWK Technologies, Inc.

Discover Sage Intacct’s Deferred Revenue Capabilities

This walkthrough of the Sage Intacct Deferred Revenue features will seek to answer your top questions and guide you step by step on the Revenue Recognition capabilities included with this accounting software. The native functionality in Intacct far outpaces what your business could achieve with manual tracking and spreadsheets in Excel, delivering state-of-the-art automation, seamless compliance and more consistent visibility. Continue reading below to discover how to improve your reporting and take better control of your business’s financial management:

Can Sage Intacct be set up to manage Deferred Revenue?

- Yes, the Revenue Management subscription can be turned on and configured for Revenue Recognition in Order Entry and/or Accounts Receivable.

How is Deferred Revenue recorded?

- Once Revenue Recognition is configured with the necessary templates and schedules, and the proper General Ledger accounts and journals are assigned, you can begin making deferred revenue entries in Sage Intacct.

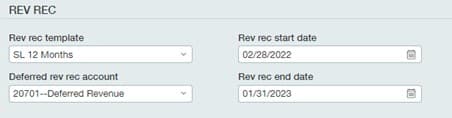

- At the time of Sales Order creation, or Invoice creation in either Order Entry or Accounts Receivable, you choose a Revenue Recognition template to follow, and a timeline for the schedule to be used by that template.

What methods are available for scheduling the recognition of Deferred Revenue?

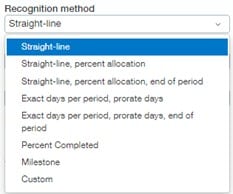

- Revenue Recognition Templates can be set up with any of several recognition methods.

- Correspondingly, the recognition schedule period can be set to Monthly, Quarterly, Semi-Annually, or Annually, and the specific Posting Day can also be chosen.

- Posting can be configured to occur Automatically or Manually, and to begin at either the Transaction Date or a user specified date.

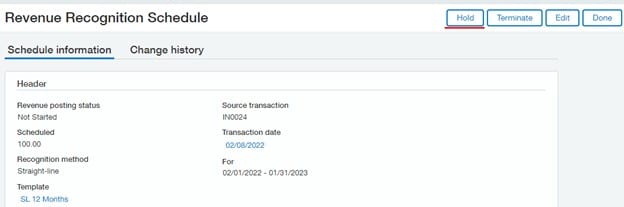

Can revenue recognition be placed on hold?

- Yes, it is possible place the recognition on hold.

- Additionally, for when revenue recognition is resumed from hold status, the Revenue Recognition Template can be configured to either immediately catch up on missed periods, or push the schedule further into the future.

- Revenue Recognition schedules can also be terminated, manually edited, or reallocated to a different schedule.

What reporting options are available for Deferred Revenue?

- Four Standard Deferred Revenue reports are available in Intacct:

- Deferred Revenue Details Report

- Show all Deferred Revenue based on input date range

- Filter by status, accounts, any dimensions used, revenue recognition template and category

- Format in summary or detail, modify grouping and sorting

- Deferred Revenue Details Report

-

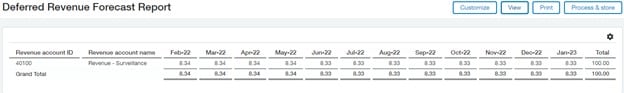

- Deferred Revenue Forecast Report

- Show all future Deferred Revenue

- Filter by status, accounts, any dimensions used, revenue recognition template and category

- Format in summary or detail, modify grouping

- Report by Revenue Account or Deferred Revenue Account

- Deferred Revenue Forecast Report

-

- Deferred Revenue Forecast Graph

- Same function as the Deferred Revenue Forecast Report, but shown as a graph

- Display as Line, Column, Stacked Column, Parallel Column, Bar, Stacked Bar, Area, or Stacked Area graph types

- Deferred Revenue Forecast Graph

-

- Deferred Revenue Revaluation Report

- For multi-currency companies only

- Used to revalue revenue recognition schedule entries using a different exchange rate type and “as of” date if desired

- Shows currency Gain/Loss for every row of the revenue recognition schedule-entry table

- Deferred Revenue Revaluation Report

Get More Sage Intacct Tips & Tricks with SWK Technologies

Sage Intacct offers plenty of options for tracking deferred revenue and other financial reports, and SWK Technologies will help you uncover the best workflow fit for your current processes. Visit our Intacct resource pages to learn more and get in touch with our experts to see more tips, tricks, updates, news and improvements for your modern cloud accounting software.

Contact SWK here to discover more Tips & Tricks for Sage Intacct and get the most out of your financial management systems.

See SWK’s Sage Intacct Training Resources